Discover how a 1031 exchange can help you grow your real estate portfolio, defer taxes, and build lasting wealth in 2025 — with expert guidance from Shirley Coomer, a licensed Realtor® with 20+ years at Keller Williams Realty.

What Is a 1031 Exchange?

Have you ever thought about how much faster your real estate wealth could grow if you didn’t have to pay capital gains taxes after every sale? A 1031 exchange lets you sell investment property and reinvest the profits into a “like-kind” property — without paying taxes immediately.

Examples of like-kind properties:

Apartment buildings

Retail shopping centers

Industrial warehouses

Raw land

Farmland

Duplexes or multi-family buildings

👉 You are not limited to exchanging “similar” property types—a duplex could be exchanged for raw land, or retail for industrial.

Who Should Consider a 1031 Exchange in 2025?

1. Investors Looking to Upgrade

Is your current property underperforming? Trade up to a newer, higher-income property with fewer maintenance issues. If you’ve maxed out depreciation (27.5 years), a 1031 exchange can restart your tax advantages.

2. Investors Seeking Diversification

Want to spread your investments across multiple markets? Diversify your portfolio by exchanging one large property for several smaller ones in different markets.

3. Investors Planning for Retirement

Tired of hands-on property management? Exchange into Delaware Statutory Trusts (DSTs) for passive income.

🔹 What if you could reposition your portfolio into income-producing properties with little to no landlord responsibilities?

Key Benefits of a 1031 Exchange

Increased Cash Flow: Reinvest in higher-performing assets.

Portfolio Optimization: Realign your portfolio with your goals.

Tax-Deferred Wealth Building: Keep more capital working for you.

Greater Flexibility: You have time to find the right replacement.

🔹 Would you rather keep your entire gain working for you—or give a third of it to the IRS?

Why Choosing the Right Real Estate Agent Is Critical

According to Dan Ihara, “General industry data shows that up to 40% of 1031 exchanges fail, often due to missed deadlines, difficulty finding suitable replacement properties, or negotiation breakdowns.”

With the right planning process, we can ensure yours won’t fail because we begin before your property closes, and preferable before you put your property on the market.

A skilled 1031 Exchange Real Estate Agent will:

Help you identify replacement properties quickly

Coordinate with your Qualified Intermediary (QI)

Structure your deal to meet IRS regulations

🔹 Isn’t it smarter to have an expert by your side to protect one of the largest investments you’ll ever make?

1031 Exchange Rules You Must Know in 2025

1. Full Tax Deferral Requirements

Buy equal or greater value properties (after standard costs)

Reinvest all equity

Replace or cover any mortgage with a new loan or cash

2. You Can Cross State Lines

Sell in one state, buy in another.

U.S. territories allowed (except Puerto Rico).

3. Timing Is Critical

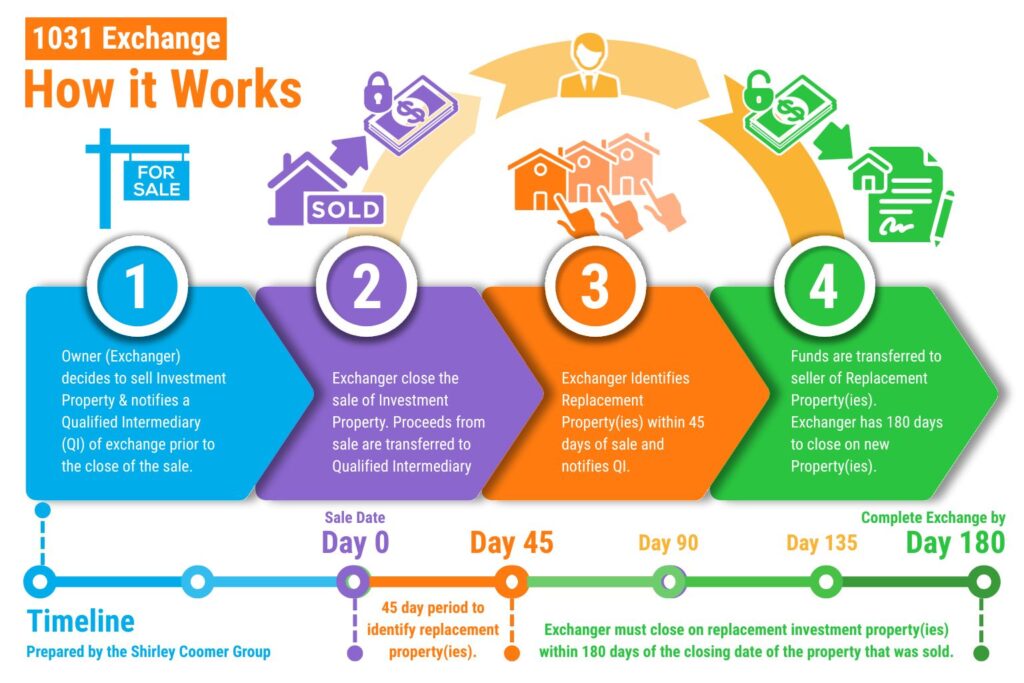

1. Day 0: Sell Investment Property

The clock starts when your property closes.

Funds must be transferred to a Qualified Intermediary (QI).

2. Day 45: Identify Replacement Properties

You have 45 calendar days to identify up to three properties.

You must notify your QI in writing.

3. Day 180: Purchase Replacement Property

You have 180 days from Day 0 to close on your replacement property.

Funds held by the QI are transferred directly to the seller.

⚠️ Deadlines are non-negotiable. Missing them invalidates your exchange.

🔹 If setting up properly from day one means keeping six or seven figures of your wealth working for you, wouldn’t it be worth the extra preparation?

How a 1031 Exchange Works

You must:

Start before you close your sale

Hire a Qualified Intermediary to hold the proceeds

Structure your documents properly from the beginning

🛑 You cannot sell first, then decide later to do a 1031 exchange.

🔹 If setting up properly from day one means keeping six or seven figures of your wealth working for you, wouldn’t it be worth the extra preparation?

Advanced 1031 Exchange Strategies for 2025

➔ Forward Exchange

Sell first, buy later — the traditional route.

➔ Reverse Exchange

Buy your new property first, then sell your old one.

➔ Construction Exchange

Buy a fixer-upper and use exchange proceeds to improve it.

➔ DST (Delaware Statutory Trust) Exchange

Own a fraction of large institutional-grade properties without landlord responsibilities. (For example, an Amazon warehouse, hotel, assisted living, etc.)

🔹 Would you like to invest in Class A commercial properties usually reserved for multi-millionaires?

Frequently Asked Questions

❓ What is a 1031 Exchange?

✅ A 1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds into like-kind investment property.

❓ How long do I have to complete a 1031 Exchange?

✅ 45 days to identify properties, and 180 days from the sale to close.

❓ Can I buy in a different state?

✅ Yes. You can sell in one U.S. state and purchase in another.

❓ Can I use a 1031 Exchange for a vacation home?

✅ Only if it meets strict IRS rules for rental use and limited personal use.

❓ Why should I use a professional?

✅ An experienced 1031 Exchange agent helps avoid costly mistakes and ensures IRS compliance

Conclusion: Will You Be Among the Successful 60%?

A 1031 exchange can be a powerful lever to accelerate your real estate growth—but only if done correctly. The difference between success and failure often comes down to having the right team behind you.

Don’t gamble with your portfolio. Partner with a skilled real estate agent and trusted professionals who specialize in 1031 exchanges.

Final Questions to Consider:

Do you know how your investment property is performing?

Are you ready to unlock the true potential of your real estate investments?

Do you want to protect your hard-earned equity and grow your portfolio strategically?

If all it took was the right team, would you take the next step today?

Contact me today for a strategy session or an Asset Performance Test.

About the Author

Shirley Coomer

602-770-0643

Licensed Realtor® | Keller Williams Realty

Certified Member of the KW Planner Community

Shirley Coomer is a trusted real estate advisor with over two decades of experience helping clients across Arizona protect their wealth and invest strategically. She specializes in 1031 Exchanges, passive income strategies, and wealth planning for investors and retirees.