If you are thinking about selling an investment property and using a 1031 exchange, timing matters more than almost anything else. I have seen otherwise solid exchange plans fail, not because the property did not sell, but because one key date was missed by a single day. When that happens, there is no appeal, no extension, and no workaround.

The IRS applies 1031 exchange deadlines strictly. Weekends count. Holidays count. Delays count. Understanding these dates before you list can be the difference between deferring capital gains and triggering a large, unexpected tax bill.

Why 1031 exchange key dates are strictly enforced

A 1031 exchange is governed by federal tax law, not by contract flexibility or local custom. The IRS deadlines are written to be clear and uniform, and they are applied exactly as written.

If a deadline is missed, even for a reason that feels reasonable, the exchange fails. The sale is then treated as a taxable event. You may also want to review how the Arizona capital gains exclusion works in certain sale situations.

This is why sellers should understand the timeline before the transaction begins, not while they are already under pressure.

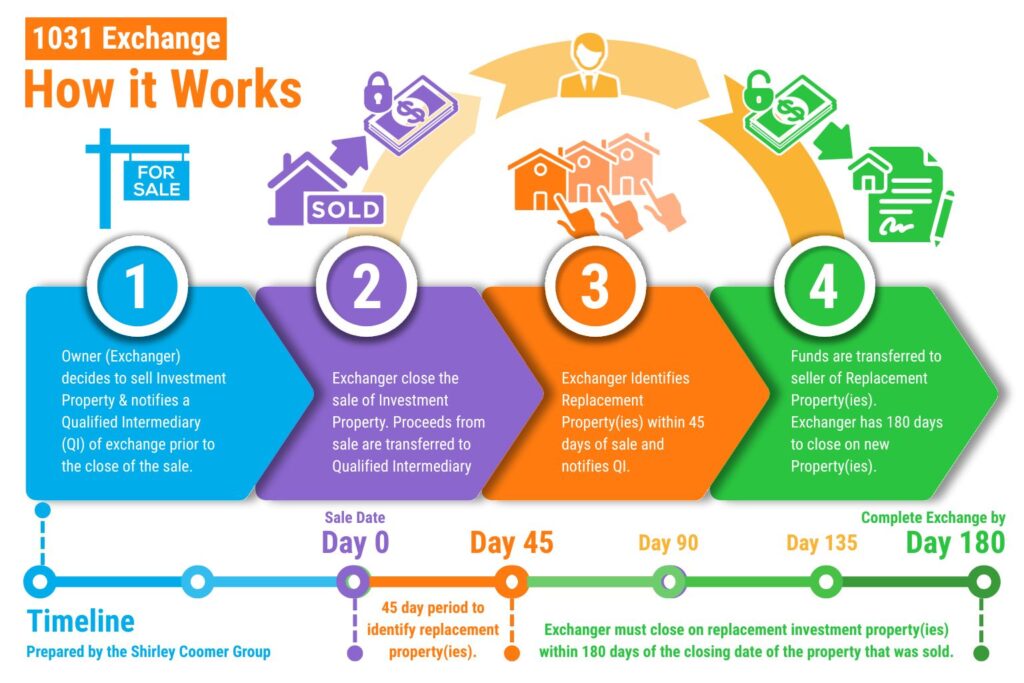

The two dates that control every 1031 exchange

There are only two official deadlines in a standard 1031 exchange, but both carry absolute authority.

The 45-day identification deadline

Day one begins the day after your relinquished property closes. From that point, you have exactly 45 calendar days to identify your replacement property or properties in writing.

Calendar days means weekends and holidays are included. If Day 45 falls on a Sunday or a federal holiday, the deadline does not move.

Identification must be delivered properly, typically to your qualified intermediary. Verbal identification does not count.

The 180-day exchange completion deadline

You also have 180 calendar days from the same closing date to complete the purchase of one or more of the identified replacement properties.

If closing occurs on Day 181, even by a few hours, the exchange fails. Financing delays, appraisal issues, or construction setbacks do not pause the clock. Financing structure can affect whether you close on time, so understanding Arizona mortgage timelines is important.

One simple rule applies: if you do not close by Day 180, the exchange is over.

Why weekends and holidays still count

Many sellers assume there is built-in flexibility for holidays or personal emergencies. There is not.

The IRS does not pause exchange timelines for weekends, travel issues, lender delays, or escrow complications. Unless there is a rare, federally declared disaster exception, the deadlines stand as written.

This is why planning needs to assume every day counts.

Why replacement property planning should start before listing

One of the biggest mistakes I see is waiting until the sale closes to begin thinking about replacement options. By that point, the exchange clock is already running.

In Phoenix metro and East Valley areas like Mesa, Chandler, Gilbert, and Scottsdale, well-priced investment properties often move quickly. Waiting until Day one to start searching adds unnecessary risk during the 45-day identification period.

I encourage sellers to explore replacement options before listing. This does not mean committing early. It means understanding inventory, price ranges, and realistic timelines so decisions are not rushed later. Clear criteria also help when buying Arizona investment property.

How early planning reduces exchange risk

When sellers prepare in advance, several things improve immediately:

- You already know which property types align with your goals

- You understand current pricing and closing timelines

- You avoid identifying weak or unrealistic properties just to meet a deadline

I have worked with Phoenix-area sellers who were able to identify replacement properties within days of closing because the groundwork was already done. That preparation removes pressure and improves outcomes.

Common timing mistakes I see in Arizona exchanges

Based on my experience working with investment property sellers, these issues come up often:

- Waiting until closing to search for replacement properties

- Assuming holidays extend deadlines

- Underestimating how long inspections, repairs, or financing can take

- Identifying properties without realistic closing timelines

Sellers should also understand typical Phoenix closing costs before structuring an exchange.

Each of these mistakes is avoidable with early coordination and realistic planning.

How my experience helps sellers navigate exchange timelines

I am Shirley Coomer, a licensed Arizona real estate agent with Keller Williams Realty, serving the Phoenix metro area since 2005. I regularly work with sellers of rental homes and small investment portfolios who are considering 1031 exchanges as part of a broader wealth or transition plan.

My role is not to give tax advice. That belongs to your CPA and qualified intermediary. My role is to help align real estate timing with IRS rules so the exchange has a realistic chance of success.

That includes coordinating listing strategy, setting realistic expectations, and helping sellers think through replacement options early, all with the calendar in mind.

Why local Phoenix market knowledge matters

Arizona market dynamics matter when deadlines are fixed. In areas like Ahwatukee, Arcadia, and parts of Scottsdale, competition, inspections, and lender timelines can affect how quickly a transaction moves from contract to closing.

Local experience does not change IRS rules, but it helps sellers plan within them.

Frequently asked questions about 1031 exchange key dates

What happens if I miss the 45-day identification deadline?

If the 45-day identification deadline is missed, the exchange fails and the sale becomes taxable.

Do weekends and holidays really count?

Yes. The IRS counts calendar days. Deadlines are not extended for weekends or holidays.

Can I identify a property and change my mind later?

You may only close on properties that were properly identified by Day 45. New properties cannot be added after the deadline.

Should I talk to a real estate agent before listing?

Yes. Early coordination helps align pricing, timing, and replacement strategy before the exchange clock starts.

Planning ahead gives you options, not pressure

A successful 1031 exchange is rarely about speed. It is about preparation. When sellers understand the key dates and plan around them before listing, they gain clarity and control instead of stress.

If you are a Phoenix-area investor considering selling an investment property and want to understand how 1031 exchange key dates affect your timeline, I can help you think through the real estate side of that decision.

You can call or text me at 602-770-0643 or email me at scoomer@kw.com to talk through your options before the clock starts.