Before we get into the Chandler Real Estate Market Report for December 2020, I have a commentary written by Tina Tamboer. Tina is the Senior Housing Analyst with the Cromford report. She was nice enough to let us use her summary of the Greater Phoenix Metro area as a backdrop for what is happening in Chandler this month. Here is her commentary…..

?️ The Greater Phoenix Metro Summary Analysis Real Estate Market Report

Supply Down 48%, Contracts Up 35%

CARES Act and Eviction Moratorium Due to Expire December 31st

? For Buyers:

Existing protections in place for homeowners during times of financial hardship have come to the forefront in 2020. While both renters and homeowners alike were struck with unemployment and loss of income this year, homeowners in particular were provided with more immediate relief and a pathway to recovery than their renting counterparts.

Case in point, there are few experts in the field predicting a foreclosure crisis for homeowners; however there are many housing experts concerned about an eviction crisis for renters after the eviction moratorium ends December 31st. Under normal circumstances in Arizona a homeowner typically has to miss multiple monthly payments before the lender files a Notice of Trustee Sale, which then provides another 90 days for the homeowner to remediate the situation prior to foreclosure. However, a renter can be at risk of eviction within a few shorts weeks after missing a single rent payment depending on their landlord’s disposition and rental agreement.

The CARES Act

The CARES Act extended another layer of protection for homeowners through forbearance, allowing them to postpone their payments in 3 month increments for up to a year without an effect on their credit. Many lenders have already put in place refinance options after forbearance for homeowners who have accumulated thousands of dollars in unpaid mortgage payments. There is no such plan for renters after the eviction moratorium. Their rents will be due in full and if they haven’t received rental assistance or sufficient unemployment benefits to cover the amount owed, they will be facing eviction and their credit will be affected.

So for those questioning whether or not purchasing a home is a good financial decision, the answer is yes. The value of owning a home is not just in its market value, but in stabilizing monthly housing costs during a period of rising rents and the comfort of more protection during times of financial and job insecurity. Losing one’s home, whether rented or owned, is one of the most stressful things a human being can endure.

? For Sellers:

If you are one of the many homeowners facing the end of a forbearance period sometime in the next 3-4 months, you have at least 5 options to remediate your situation. 1) STAY IN YOUR HOME and consult your retirement plan administrator about tapping into your retirement account without penalty until December 31st to cover your unpaid payments; 2) STAY IN YOUR HOME and consult a lender about refinancing your unpaid payments into a new loan; 3) MOVE OUT and rent your home for more than your mortgage payment to cover missed payments or replenish your retirement account; 4) MOVE OUT and consult a lender about acquiring a new loan on a more affordable home; 5) MOVE OUT and sell your home for more than your mortgage balance, walk away with your equity and credit intact to purchase another day.

2008 Housing Crash

None of these options were viable solutions for homeowners facing the 2008 housing crash 12 years ago. These options are why there is little risk of a foreclosure crisis and price crash in 2021. Because population growth has consistently outpaced housing growth every year over the past 10 years, rents and values are projected to continue rising through 2021 in Greater Phoenix unless builders are able and willing to ramp up production at ludicrous speed. They are doing their best, but even 25,549 permits issued and 19,889 sales closed on brand new single family homes through October this year hasn’t proven to be enough to satisfy the level of demand for housing that has descended on Greater Phoenix. Sellers need not worry about their home values declining anytime soon.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2020 Cromford Associates LLC and Tamboer Consulting LLC

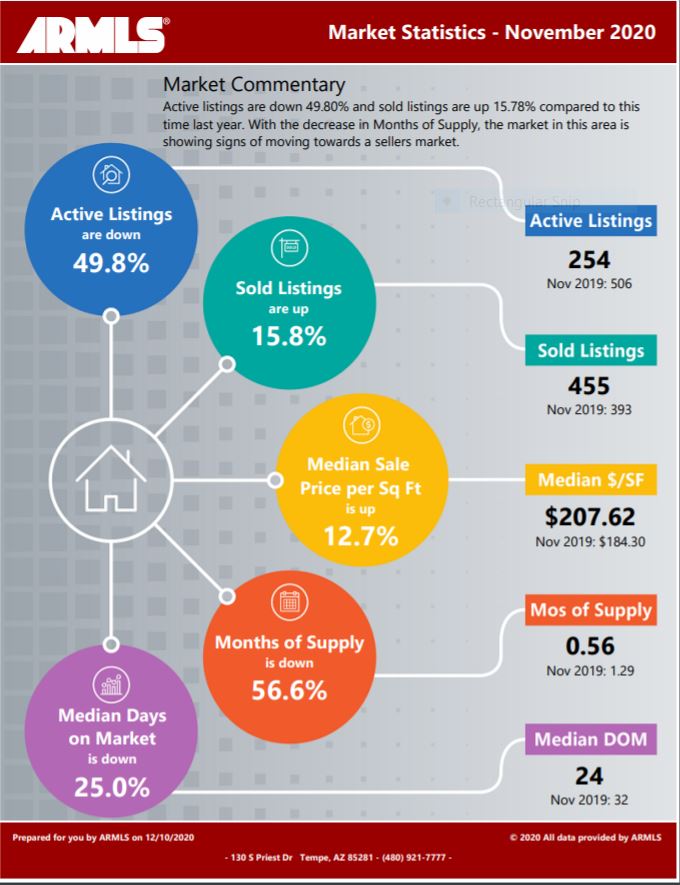

Below you will find the statistical breakdown and more for the Chandler area Real Estate Market Report November 2020.

View All Current & Past Phoenix & East Valley Real Estate Market Reports

? Below is a snapshot of Chandler’s Real Estate Market Statistics for November 2020

?️ What are the Average Temperatures in Phoenix?

| Month | Low | High |

|---|---|---|

| Jan | 43.4°F | 65.0°F |

| Feb | 47.0°F | 69.4°F |

| Mar | 51.1°F | 74.3°F |

| Apr | 57.5°F | 83.0°F |

| May | 66.3°F | 91.9°F |

| Jun | 75.2°F | 102.0°F |

| Jul | 81.4°F | 104.2°F |

| Aug | 80.4°F | 102.4°F |

| Sept | 74.5°F | 97.4°F |

| Oct | 62.9°F | 86.4°F |

| Nov | 50.0°F | 73.3°F |

| Dec | 43.5°F | 65.0°F |

Phoenix’s coldest month is January when the average temperature overnight is 43.4°F. In July, the warmest month, the average day time temperature rises to 104.2°F. If you would like to see specific homes as they come on the market, click here to get email updates.

? A look at Chandler’s current Sales Price. Real Estate Market Report for December 2020

In November, Chandler’s Median Sales Price was $378,000 down from last months $389,900 (but higher than September’s $375,000. With inventory continuing to run at historic lows, listings are getting multiple bids thus putting pressure on the price. However, you can see there is some volatility in price as well.

If you are in the process of Buying or Selling a Home, Click on the highlighted link to see a number of interesting articles.

❓ What does this mean if you are a Buyer or a Seller?

Real Estate Market Report

As the chart above shows, Inventory in Chandler continues to drop. This month we are at .56 months of inventory as compared to last months .59 months and the prior months .61. Buyers should expect multiple offers since the inventory is so low. Make your offers with as few contingencies as possible. Know the Market Value of the home because you may need to go over the list price to get the house.

Sellers should be prepared for multiple bids on their homes. We are seeing these historic low inventory levels creating a bidding war which is putting pressure on the buyers to bid above the sales price to get the home. Know the market value of your home, so you don’t accept an offer that causes an appraisal issue.

If you would like to see specific homes as they come on the market, click here to get email updates.

?️ What is the annual rainfall in Phoenix?

| Month | Precipitation |

|---|---|

| Jan | 0.83in. |

| Feb | 0.77in. |

| Mar | 1.07in. |

| Apr | 0.25in. |

| May | 0.16in. |

| Jun | 0.09in. |

| Jul | 0.99in. |

| Aug | 0.94in. |

| Sept | 0.75in. |

| Oct | 0.79in. |

| Nov | 0.73in. |

| Dec | 0.92in. |

The driest month in Phoenix is June with 0.09 inches of precipitation, and with 1.07 inches March is the wettest month.

?️ Homes For Sale in Chandler AZ

Below are Homes that have come on the market in the last 7 Days around the Median price range. Also below the pictures, you will see a Chart of all the Chandler homes by price and Type: Below are all the homes available in the city of Chandler by Dollar amount and type:

? Below you will see the links for the other cities in the East Valley:

-Phoenix

-Gilbert

-Tempe

View All Current & Past Phoenix & East Valley Real Estate Market Reports

Contact the Shirley Coomer Group at Keller Williams Realty Sonoran Living

Call or Text: 602-770-0643 for more Real Estate Information.