Before we get into the Gilbert Real Estate Market Report for April 2022, I have a commentary written by Tina Tamboer. Tina is the Senior Housing Analyst with the Cromford report. She was nice enough to let us use her summary of the Greater Phoenix Metro area as a backdrop for what is happening in Gilbert this month. Here is her commentary…

?️ The Greater Phoenix Metro Summary Analysis Real Estate Market Report

57% of Sales are Over Asking Price

Median Sale Price Up 27% to $457,000

? For Buyers:

Supply is still the top concern for buyers these days and we continue to look to new construction to add new homes and ease the pressure on price. The top areas for new single-family home sales are the West Valley, with 44% market share, and Pinal County, with 27% market share. The Southeast Valley comes in 3rd with 17%. If you’re looking to the West Valley for a new home, your best bets are Laveen, just east of the new 202 freeway loop, and cities just west of the 303 freeway such as Peoria, Surprise, Waddell, Goodyear, and Buckeye. In the Southeast Valley, new home subdivisions are concentrated in East Mesa, Queen Creek, South Gilbert, and South Chandler. In Pinal County, Casa Grande and Maricopa have the newest home sales.

As of February 2022, the median cost of a new home closed was $447,000 overall with a median size of 2,197 sq. ft. That was just under the resale median of $450,000 in the same month, which had a median size of 1,783 sq. ft. In the West Valley, the new home median is $443,000 with 2,237 sq. ft. In the Southeast Valley, that median is $579,000 and 2,456 sq. ft., and in Pinal County, it is $385,000 with 1,888 sq. ft.

New Construction

New home developers continue to struggle with a labor shortage and supply chain issues. It’s not uncommon for builders to estimate 14-16 months before the completion of a home. Because prices have been rising sharply, this means that by the time a home is built, the costs to complete it have gone up and it’s already worth significantly more than the negotiated purchase price. For this reason, some builders are including escalation clauses in their contracts that allow them to raise the price prior to the close of escrow to accommodate the higher costs to build and closely reflect the current market value. In addition to escalation clauses, a handful of builders are including restrictions on when a homeowner can sell or rent the home after the close. It’s important to read builder contracts closely and ensure you understand every section before moving forward.

? For Sellers:

The market continues to heavily favor sellers. Supply is still 76% below normal for this time of year and demand is 6% above normal. However, demand is declining in response to recent increases in interest rates. Just 30 days ago, demand was 12% above normal, and 30 days prior to that it was 21% above normal.

Buyers across the nation are in the best financial shape seen in decades with an average credit score of 714 last year, according to Experian, and Maricopa County has the lowest percentage of consumers with credit scores below 660 in at least 22 years. However, in just a few short months, the average interest rate increased from 3.1% in December to 4.7% by April. This resulted in a $500 increase in the estimated payment on a 1,500-2,000 sq. ft. home, pushing the cost to buy significantly higher than the cost to rent in Greater Phoenix.

What to expect?

This does not mean the market is at its peak, or at the precipice of a price decline. The only response we are seeing at this time is a sharp increase in supply between $500K-$1M over the past 2 weeks, a price range that happens to have less interest from investors and 2nd homeowners, and a higher market share of owner-occupants. Despite this increase in supply, the median days on market prior to the contract is still only 7 days, and there aren’t any bold movements in price reductions or seller concessions. Until we see an upward shift in price reductions and seller concessions, we will not see a flattening out or decline in sale prices.

Currently, April closings to date have seen 57% of closings over the asking price and a 22% appreciation rate compared to April 2021 thus far. While it’s reasonable to expect price appreciation to slow down at some point, there is little evidence at this stage to show prices declining in the near future.

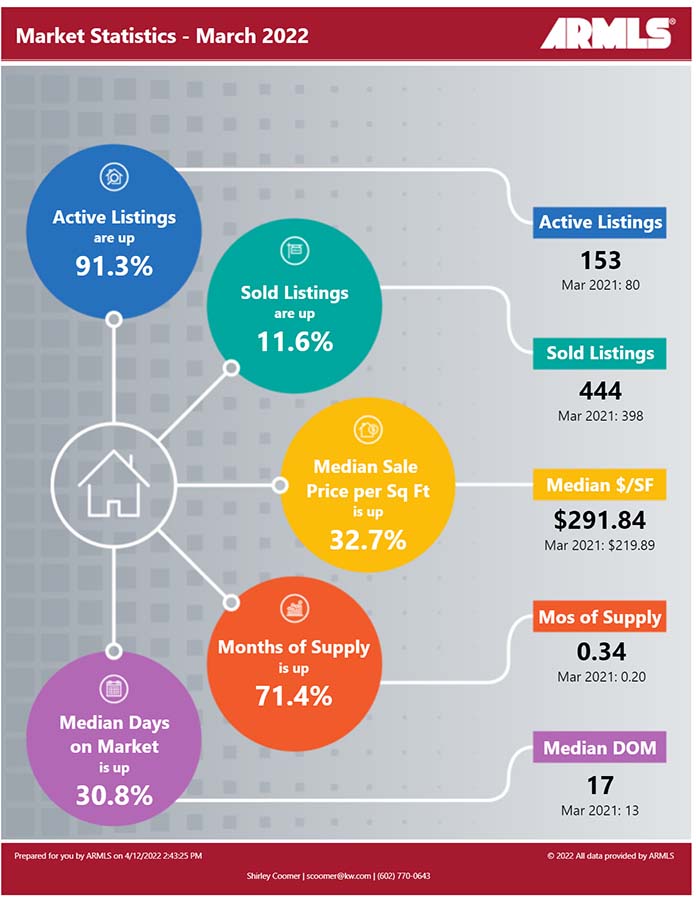

Below you will find the statistical breakdown and more for the Gilbert area Real Estate Market Report March 2022.

View All Current & Past Phoenix & East Valley Real Estate Market Reports

? Below is a snapshot of Gilbert’s Real Estate Market Statistics for March 2022

?️ What are the Average Temperatures in Phoenix?

| Month | Low | High |

|---|---|---|

| Jan | 43.4°F | 65.0°F |

| Feb | 47.0°F | 69.4°F |

| Mar | 51.1°F | 74.3°F |

| Apr | 57.5°F | 83.0°F |

| May | 66.3°F | 91.9°F |

| Jun | 75.2°F | 102.0°F |

| Jul | 81.4°F | 104.2°F |

| Aug | 80.4°F | 102.4°F |

| Sept | 74.5°F | 97.4°F |

| Oct | 62.9°F | 86.4°F |

| Nov | 50.0°F | 73.3°F |

| Dec | 43.5°F | 65.0°F |

Phoenix’s coldest month is January when the average temperature overnight is 43.4°F. In July, the warmest month, the average daytime temperature rises to 104.2°F. If you would like to see specific homes as they come on the market, click here to get email updates.

? A look at Gilbert’s current Sales Price. Real Estate Market Report for April 2022

In March, Gilbert’s Median Sales Price was $600,000 up from last month’s $564,900 and the prior months’ $535,000, $532,000 and $536,500. As inventory levels remain at unheard of low levels, there has been continued pressure on the sales price as folks need to bid above the listing price to be the winning bid on the house.

If you are in the process of Buying or Selling a Home, Click on the highlighted link to see a number of interesting articles.

❓ What does this mean if you are a Buyer or a Seller?

Real Estate Market Report

As the chart above shows the Phoenix housing market Inventory remains at historic low levels. Buyers should be prepared to jump on any listing that fits their needs. With inventory at these lows, make sure you make your offer as clean as possible (no contingencies). Based on Tina’s comments above, you may have to pay over the list price to get the deal.

Sellers should expect multiple offers due to this low inventory level. We are seeing many more multiple offers as inventory drops. Know the market value of your home. When you start getting offers above list price and potential market price, be cognizant of a potential appraisal issue or look for offers with appraisal waivers/contingencies.

If you would like to see specific homes as they come on the market, click here to get email updates.

?️ What is the annual rainfall in Phoenix?

| Month | Precipitation |

|---|---|

| Jan | 0.83in. |

| Feb | 0.77in. |

| Mar | 1.07in. |

| Apr | 0.25in. |

| May | 0.16in. |

| Jun | 0.09in. |

| Jul | 0.99in. |

| Aug | 0.94in. |

| Sept | 0.75in. |

| Oct | 0.79in. |

| Nov | 0.73in. |

| Dec | 0.92in. |

The driest month in Phoenix is June with 0.09 inches of precipitation, and with 1.07 inches March is the wettest month.

?️ Homes For Sale in Gilbert AZ

Below are Homes that have come on the market in the last 7 Days around the Median price range. Also below the pictures, you will see a Chart of all the Gilbert homes by price and Type: Below are all the homes available in the city of Gilbert by Dollar amount and type:

? Below you will see the links for the other cities in the East Valley:

View All Current & Past Phoenix & East Valley Real Estate Market Reports

Contact the Shirley Coomer Group at Keller Williams Realty Sonoran Living

Call or Text: 602-770-0643 for more Real Estate Information.