Before we get into the Gilbert Real Estate Market Report for March 2022, I have a commentary written by Tina Tamboer. Tina is the Senior Housing Analyst with the Cromford report. She was nice enough to let us use her summary of the Greater Phoenix Metro area as a backdrop for what is happening in Gilbert this month. Here is her commentary…

?️ The Greater Phoenix Metro Summary Analysis Real Estate Market Report

Short Term Rentals up 23% NE Valley

MLS Rental Supply up 60% in 5 Months

? For Buyers:

Don’t be fooled by the small increase in supply and decrease in demand compared to last year. The Greater Phoenix housing market is far from weak and will continue to see prices appreciate in the foreseeable future. Housing market indicators move slowly, unlike other types of investments such as stocks or currencies. When events such as interest rate hikes or stock market fluctuations occur, there isn’t an immediate measurable response in housing prices. Consumers may “panic sell” stocks, crypto, or even their belongings; however, selling the roof over their head or a performing rental is typically the last resort. For this reason, jolts to the economy (like a sudden pandemic or economic sanctions) need to be in effect for many months without improvement for housing to see prices finally respond.

Vacation Rental

A unique player in the housing market is the short-term vacation rental. This product is specifically prolific in Northeast Valley cities such as Scottsdale, Paradise Valley, and Cave Creek. According to AirDNA, Scottsdale alone was estimated to have 5,400 active short-term rentals as of December 2021, up 23% from the 4,400 estimated just last September and equating to over 4% of the existing housing supply for that city. This changes the game in evaluating the value of property in high tourist areas like Kierland and Old Town Scottsdale. Instead of the traditional route utilizing past sales and adjusting for amenities for residential occupancy, certain homes are valued as individual businesses that come complete with a revenue stream, furnishings, established clients, websites, advertising contracts, and hired support services. Under these circumstances, appraisers have their hands full distinguishing between a business sale and residential resale when evaluating appreciation.

To compound the issue in the Northeast Valley, new construction permits are not as abundant as they are in the West Valley and Southeast Valley; meaning there is little relief in the form of future new housing supply to accommodate both full and part-time demand in the area.

? For Sellers:

Greater Phoenix is not close to peaking in price for residential resale, not with supply of homes for sale 76% below normal for March and demand 13% above normal. However, be aware that the estimated payment for a 1,500-2,000 square foot home is now $77 higher than the median rent for a similar rental leased through the Arizona Regional MLS. The rental market responds to a shift in demand faster than the resale market does because landlords are faster to respond with a lease price reduction if their investment is vacant for too long.

In 2021, median asking rents jumped from $1,855 in January to a peak of $2,395 by September, an increase of $540, and have remained between $2,300-$2,400 per month since. Tenants accommodated the increases until about June, then the median for closed leases stalled at $2,100 per month. Despite the stall, landlords continued to increase their asking rent and saw the supply of available rentals rise by 60%. This is a significant development because the only reason a landlord would decide to compensate a real estate agent by listing their rental in the MLS is if they’re not renting it fast enough through other means.

Why Look at Rentals?

You may be wondering why this matters to you as a home seller. The health of the rental market is often looked at as an indicator for the health of the resale market. If lease rates continue to go up and are successfully closed at those rates, then that’s a good indicator for resale prices as well. When rental rates reach a ceiling and stay there for months, then it’s possible the resale market may follow, but as stated earlier, resale is slow to respond. It could take many more months before the shift is realized, so for today, it’s business as usual.

Below you will find the statistical breakdown and more for the Gilbert area Real Estate Market Report February 2022.

View All Current & Past Phoenix & East Valley Real Estate Market Reports

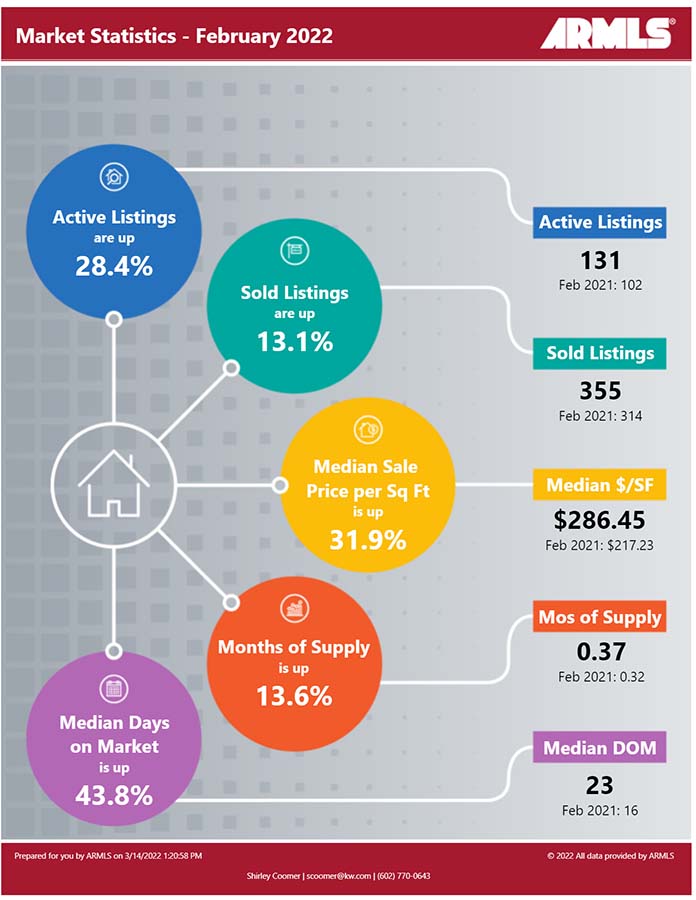

? Below is a snapshot of Gilbert’s Real Estate Market Statistics for February 2022

?️ What are the Average Temperatures in Phoenix?

| Month | Low | High |

|---|---|---|

| Jan | 43.4°F | 65.0°F |

| Feb | 47.0°F | 69.4°F |

| Mar | 51.1°F | 74.3°F |

| Apr | 57.5°F | 83.0°F |

| May | 66.3°F | 91.9°F |

| Jun | 75.2°F | 102.0°F |

| Jul | 81.4°F | 104.2°F |

| Aug | 80.4°F | 102.4°F |

| Sept | 74.5°F | 97.4°F |

| Oct | 62.9°F | 86.4°F |

| Nov | 50.0°F | 73.3°F |

| Dec | 43.5°F | 65.0°F |

Phoenix’s coldest month is January when the average temperature overnight is 43.4°F. In July, the warmest month, the average daytime temperature rises to 104.2°F. If you would like to see specific homes as they come on the market, click here to get email updates.

? A look at Gilbert’s current Sales Price. Real Estate Market Report for March 2022

In February, Gilbert’s Median Sales Price was $564,900 up from last month’s $535,000 and the prior months’ $532,000, $536,500 and $520,000. As inventory levels remain at unheard of low levels, there has been continued pressure on the sales price as folks need to bid above the listing price to be the winning bid on the house.

If you are in the process of Buying or Selling a Home, Click on the highlighted link to see a number of interesting articles.

❓ What does this mean if you are a Buyer or a Seller?

Real Estate Market Report

As the chart above shows the Phoenix housing market Inventory remains at historic low levels. Buyers should be prepared to jump on any listing that fits their needs. With inventory at these lows, make sure you make your offer as clean as possible (no contingencies). Based on Tina’s comments above, you may have to pay over the list price to get the deal.

Sellers should expect multiple offers due to this low inventory level. We are seeing many more multiple offers as inventory drops. Know the market value of your home. When you start getting offers above list price and potential market price, be cognizant of a potential appraisal issue or look for offers with appraisal waivers/contingencies.

If you would like to see specific homes as they come on the market, click here to get email updates.

?️ What is the annual rainfall in Phoenix?

| Month | Precipitation |

|---|---|

| Jan | 0.83in. |

| Feb | 0.77in. |

| Mar | 1.07in. |

| Apr | 0.25in. |

| May | 0.16in. |

| Jun | 0.09in. |

| Jul | 0.99in. |

| Aug | 0.94in. |

| Sept | 0.75in. |

| Oct | 0.79in. |

| Nov | 0.73in. |

| Dec | 0.92in. |

The driest month in Phoenix is June with 0.09 inches of precipitation, and with 1.07 inches March is the wettest month.

?️ Homes For Sale in Gilbert AZ

Below are Homes that have come on the market in the last 7 Days around the Median price range. Also below the pictures, you will see a Chart of all the Gilbert homes by price and Type: Below are all the homes available in the city of Gilbert by Dollar amount and type:

? Below you will see the links for the other cities in the East Valley:

View All Current & Past Phoenix & East Valley Real Estate Market Reports

Contact the Shirley Coomer Group at Keller Williams Realty Sonoran Living

Call or Text: 602-770-0643 for more Real Estate Information.